Well into my 4th year at Tackle and every day it still feels like we’re just getting started. With more than 550 software companies relying on our platform to help them drive revenue via low-cost, high-value cloud partnerships with the likes of AWS, Microsoft, and Google Cloud, you’d think the message would be loud and clear to the entire software-selling community: Cloud is where the MONEY is at!

And yet, we still educate organizations every day. Maybe you’ve tried leveraging cloud partnerships and selling via Cloud Providers in the past. Maybe you’re currently struggling through navigating these immense organizations and trying to master complicated new processes in order to drive revenue. Maybe you’ve gotten your products into one or more of the Marketplaces and you’re not quite selling as much (or as easily) as you’d thought. Or maybe you’re trying to figure out if this Cloud Marketplace thing is worth paying attention to. If any of those apply to you, you’ve likely been told (at least once) “You should talk to Tackle.” Why?

Along with helping software companies drive revenue through the hyperscaler Cloud Providers, each of us at Tackle have become experts in cloud selling. We’ve had to write the playbooks for successful Cloud GTM strategies and, as a result, we’ve helped hundreds of customers drive billions of dollars in Marketplace sales. And one of the most valuable things we’ve done is to help software companies learn from our experience and our data. So I thought I’d take a shot at answering some of the most common questions we get using the data we’ve collected from years of processing Marketplace transactions on behalf of some of the largest software sellers in the world.

The three most common reactions we get when we are advising new customers are:

- Is there actual growth happening in the Cloud Marketplaces?

- Are meaningful deals being transacted this way?

- Are my buyers really buying software through Cloud Marketplaces?

Our answers are yes, yes, and yes.

We often hear: “Are you sure? We only sell to large companies and our solutions aren’t click-to-buy. We require a lot of implementation work. Our sales cycle is very complicated. Our buyers are not technical.”

Our answer again: Yes. And we’ve got the data to back it up.

Is there actual growth happening in the Cloud Marketplaces?

Since Tackle sells almost exclusively through Cloud Marketplaces, I get a front row seat to observe these channels driving growth, but I also get to see even more exciting growth statistics across our customer base each day. How about a little data on that?

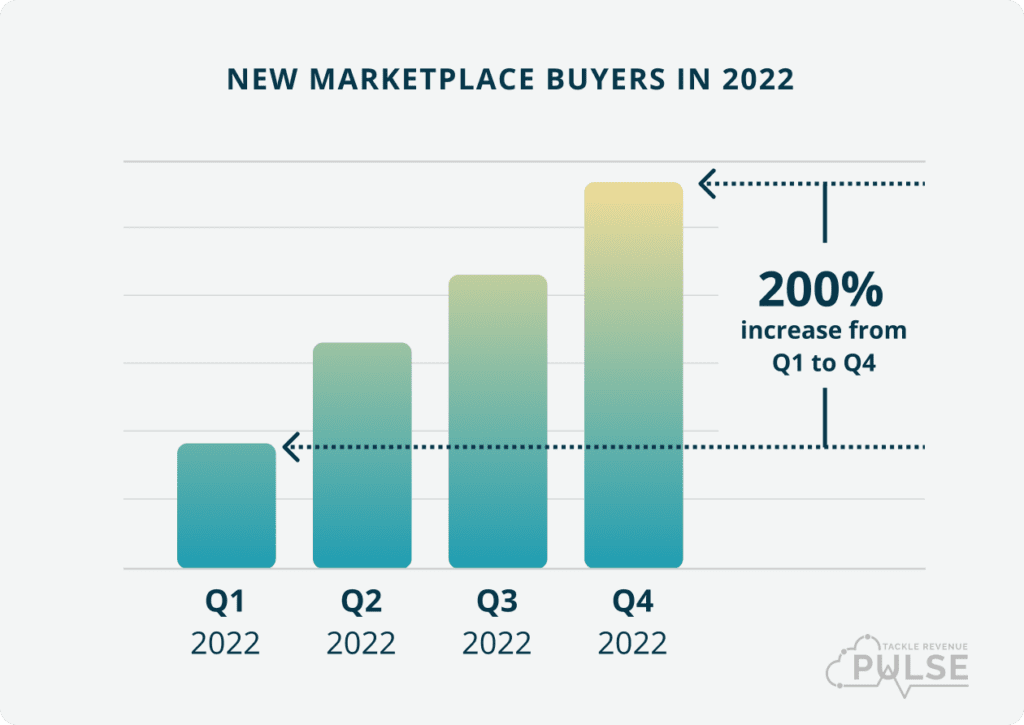

In 2022, we saw the number of new buyers increase 200% from Q1 to Q4. Year over year, we saw 35% growth from 2021 to 2022. This year, we’ve already seen those numbers outpace historicals by 15%… and that’s with still a third of the quarter left to go! So, yes, the appetite is there and yes, your buyers are there, and they’re spending money even in this crazy economic environment (more on this in the next section).

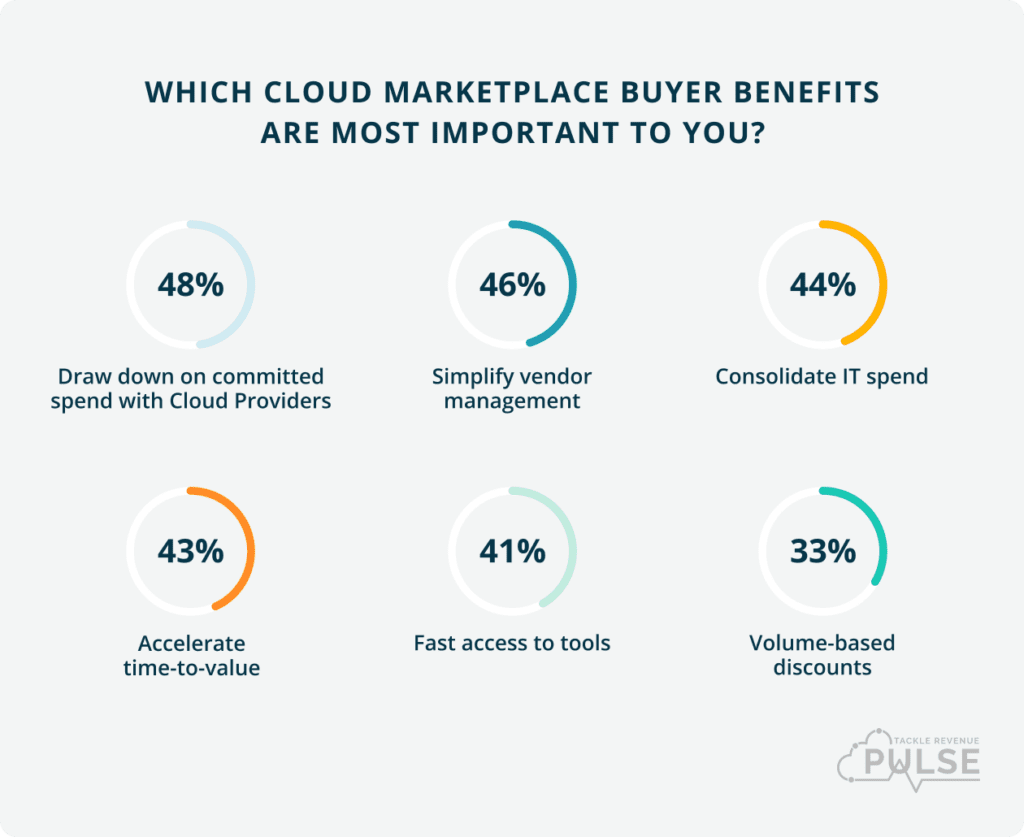

Battery Ventures recently released its State of Cloud Software Spend Report and found that the majority of the CXOs they surveyed procure software through Cloud Marketplaces, with standardized onboarding and integrations as their leading drivers. This echoes Tackle’s data from our annual State of Cloud Marketplaces Report where buyers identify draw down on committed cloud spend, simplified vendor management (onboarding), ease of contracting, and several other benefits as key to their decisions to purchase via the Cloud Marketplaces.

Are meaningful deals being transacted this way?

I can hear you now. “But big, complex deals for complicated enterprise software…those deals can’t go through Marketplaces, right?” Wrong. Emphatically. Prove it? Okay:

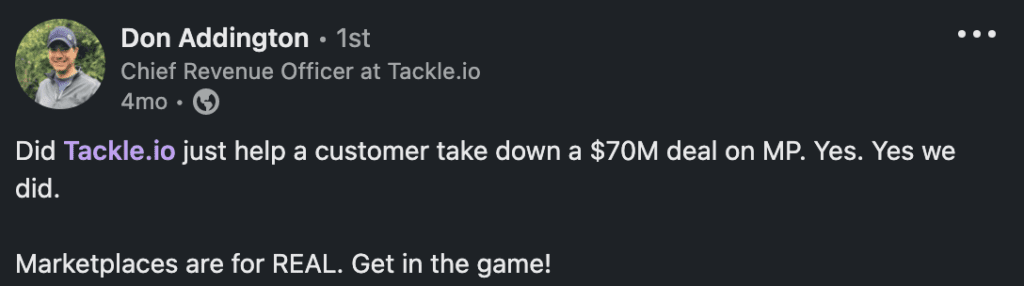

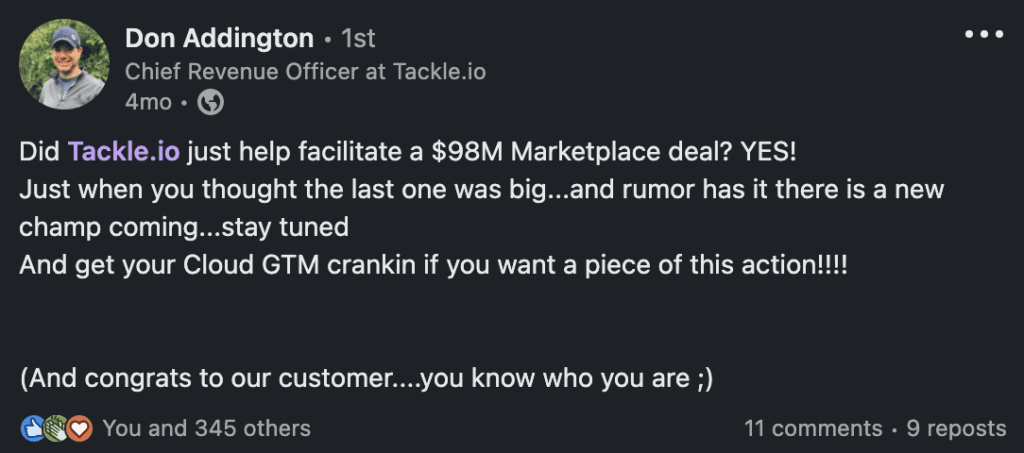

How about the several $10M deals we saw last year? Not impressed? What about the $30M deals we saw? Maybe the $70M deals we saw would raise your eyebrow. Our customers executed all of these massive transactions last year and deals of this size are increasingly becoming the norm. In fact, in Q4-22 alone, Tackle customers transacted close to $1B in Marketplace deals—and that’s just the data on the deals for Tackle customers. The holistic Marketplace numbers are even larger!

Are my buyers really buying software through the Cloud Marketplaces?

There are usually two different misconceptions wrapped up in this question: The first is that enterprise companies don’t buy through the Marketplaces and the second is that non-technical buyers don’t buy through the Marketplace.

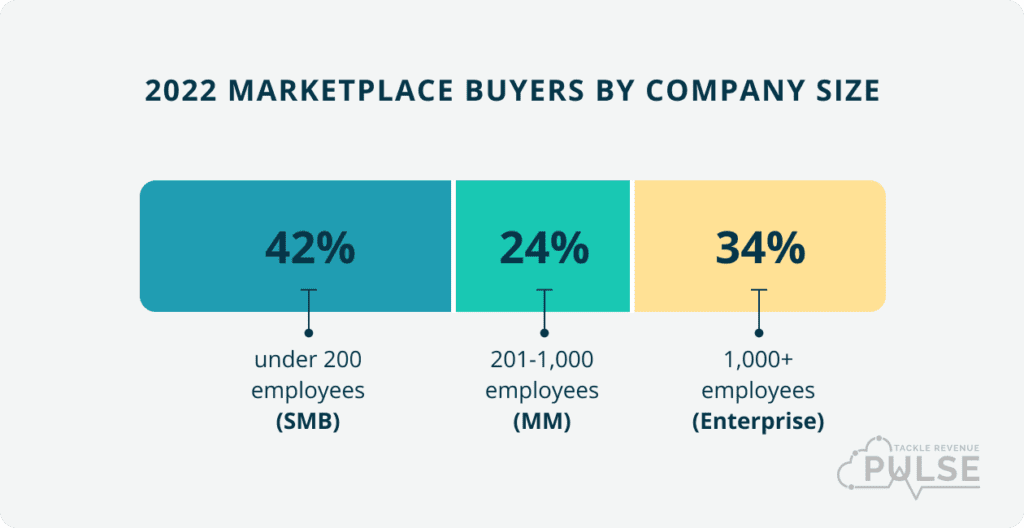

First, yes, big companies are absolutely engaging in big deals through the Cloud Marketplaces. Here’s a breakdown of company sizes that we saw buy via Marketplace last year:

- 42% companies under 200 employees

- 24% company in the 201-1,000 employee range

- 34% companies above 1,000 employees (actually 60% of this group are 5000+ employees)

Larger companies tend to have larger cloud spend and, as mentioned above, this is the number one incentive for buyers choosing to buy their 3rd party software through a Cloud Marketplace. As cloud spend continues to grow—estimates expect anywhere from 25–35+% growth in cloud spend this year—the draw for companies to transact in ways that help optimize those committed spend contracts also grows.

I know. I know. “But, Don, we sell to line of business.” “But Don, we sell to marketing.” “But, Don, we sell to sales.” Good news: according to Tackle’s data, among the top 10 verticals purchasing software via the Marketplaces are Marketing (including Sales), Retail, Media, Manufacturing, and Telecommunications.

If you still think Marketplace buyers are all developers purchasing IT tools for insignificant deployments and uninteresting dollars, our data would encourage you to think again.

While budget belts are certainly tightening and procurement cycles are most assuredly slowing down as buyers scrutinize every dollar spent even more closely, cloud spend is still strong. And dollars have been committed to the Cloud Providers as a result of multi-year contracts. Those dollars need to get spent and they could be YOUR dollars!

What’s next?

If you’re still not convinced your buyers are buying this way, I’d like to invite you to explore a free trial of Tackle Prospect, which takes your pipeline and scores each account based on their likelihood to buy in the Cloud Marketplaces. This will give you insight into who is buying where and help you build the case for a Cloud GTM strategy. I think you’ll be (pleasantly) surprised at what you find.

In the coming weeks and months, we’ll continue sharing what we learn via our unique visibility. After all, our job in life is to help software companies sell more and sell faster. So we’re putting our data to work, and I’ll keep on sharing what we learn. In the meantime, our State of the Cloud Marketplace Report is full of great data to help you better understand the overall picture, but things are changing too rapidly today (we need to stay ahead of ChatGPT, don’t we?!) for us not to share what we’re learning faster. So stay tuned for more to come!